5MF: RETHINKING BTC PREDICTION MODELS, CRYPTO MEETS MORTGAGES, MORE

The 5-minute newsletter on the important stuff in finance — explaining what’s going on, and why.

Let’s see what’s going on this week:

- Recalculating BTC Price Predictions

- BTC-backed Mortgages Arrive on Scene

- What Happened: Polygon (MATIC) Stealth Hard Fork

- Stablecoins as Magic Internet Money

- The Fed’s Tapering May Take Inflation’s ‘Transitory’ Form

Bitcoin’s On-Chain Metrics: Calm Before the Storm?

- All-time-high stablecoin on-chain flow indicates whales could be prepping to buy the dip. (link)

- With only 10% of Bitcoin’s supply left for mining (over the course of an estimated 119 years), analysts believe halving cycles will play less of a role in forecasting the price of BTC in future cycles. On-chain data could play more of a role. (link)

Rethinking BTC Price Prediction Models

Since December 4th, Bitcoin has been hanging under $50k. However, despite being in a downtrend, a reversal might be forthcoming. On-chain metrics provided by CryptoQuant show an ATH accumulation of stablecoins, surpassing the $5 billion mark.

With the crypto fear & greed index still in the extreme fear zone at 23 out of 100, whales may be preparing for an action that results in a relief rally. There are three main indicators to support this. First, there is a breakout of daily RSI (Relative Strength Index). Secondly, there is a bullish cross on a daily MACD (Moving average convergence divergence). Lastly, stablecoin BTC buying power hit a new record.

While the upside to this scenario would mean benefits in the near future, the long-term view is equally bullish. With 90% of bitcoins already mined and over 70% of the pool illiquid, Bitcoin could be setting the stage for a supply shock. With HODL culture and investor interest in full swing, some argue that Bitcoin scarcity is bound to lead to higher demand, translating to a higher BTC price.

With that said, the Bitcoin Stock-to-flow (S2F) model created by PlanB failed to materialize its $98k BTC forecast. Reliant on halving every four years as a price catalyst, the S2F model may be supplanted by increased on-chain demand metrics instead.

Novel Crypto Products Continue to Emerge; the Latest Involve Real Estate

- Bitcoin-backed mortgages make a debut in Canada. (link)

- Real estate-backed cryptocurrency run by RealEx DAO, plans to help 80 million students laden with debt by giving them RealEx steadycoin rewards for their DAO contributions. (link)

Bitcoin-backed Mortgages and Real Estate-Backed Crypto

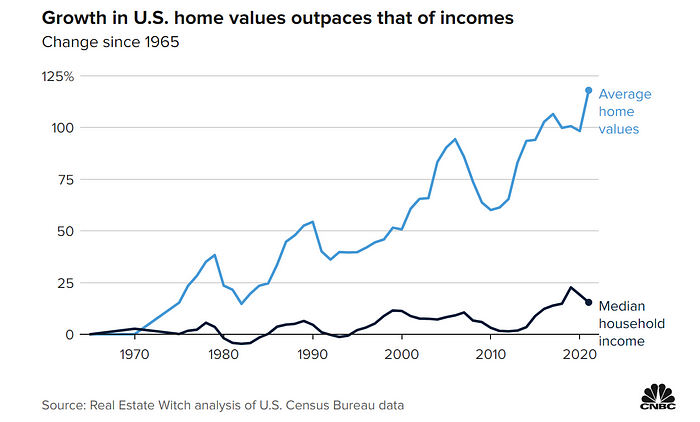

The collapse of the American dream can be summed up in one sentence. Since the 1970s, the average home price has increased by nearly 125% compared to median household income. Predictably, this doubled the percentage of renters since 1965, from 21.3 million to 43.3 million, according to data from the Pew Research Center.

Image courtesy of CNBC.

To make the situation worse, the cost of housing building materials increased along with soaring inflation. Yet, the demand for housing remains strong. Ledn seems poised to take advantage of Bitcoin’s popularity and the housing market with the world’s first Bitcoin-backed mortgage.

Thanks to joint collateral between real estate and Bitcoin holdings (equal to loan value), Ledn says it offers a monthly interest rate that’s lower than traditional alternatives. Plus, Bitcoin holders don’t have to sell their BTC to get a loan, leaving their crypto assets free to appreciate.

Another branch of financial innovation comes in the form of RealEx steadycoin, backed by inflation-hardened assets like real estate. RealEx holders can stake the tokens for yields, effectively becoming… real estate farmers? To promote the innovation, Real Ex DAO, under the umbrella of RealEx Foundation, has launched an award program for students.

Entrepreneurs continue to leverage digital assets to develop solutions for real-world problems. Whether or not these are marketing ploys built on the backs of high noise levels, or actual forms of innovation that deliver value, we’ll have to wait and see.

MATIC’s Surprise Hard Fork As a Double-Edged Sword

- Polygon (MATIC) network, a Layer 2 scaling solution for Ethereum’s Layer 1 congested traffic, quietly initiated an emergency hard-fork to address a security concern this week. (link)

- Polygon (MATIC) implements Ethereum’s EIP-1599 coin burning upgrade, poising the network for greater popularity and token price rise. (link)

Hard Fork Saves the Day, While Others Question its Decentralization

As a 16-lane highway add-on to Ethereum’s congested network, Polygon (MATIC) has grown to a respectable market cap of $14.5 billion. As a popular DeFi venue hosting the most popular dApps and 9 out of 10 metaverses, MATIC resorted to an emergency hard fork to patch up a smart contract vulnerability. This effectively sealed a possible leak spreading outwards, ensuring that all funds remain intact.

Providing network scalability has proven to be massively valuable — with a 9,800+% increase within a year. Image courtesy of coinstats.app.

Although the alertness of the Polygon team is commendable, led by co-founder Mihailo Bjelic, it did raise concerns by some members of the community. In particular, members question the extent to which the project is decentralized, and whether or not a hard fork could be used maliciously. Bjelic assured investors that his team has no control of validators nor full node operators.

With the smart contract hiccup in the rear view mirror, Polygon appears back on track to a bright future. Just last week, they bought Mir Protocol for $400 million to unroll zkRollups, dubbed Polygon Zero. Even more important for MATIC investors is the introduction of the EIP-1599 fee-burning upgrade (yes, the same thing we saw on Ethereum).

First deployed on a Mumbai Testnet, Polygon’s fee-burning mechanism will have a dual effect: reduce gas fee volatility and produce a deflationary effect that appreciates the price of MATIC tokens.

Enjoy 5MF? Click to forward it to three friends.

Stablecoins Under Scrutiny

- Dubbed ‘Stablecoins: How do they work, how are they used, and what are their risks?’, the latest congressional hearing draws criticism on the very concept of stablecoins. (link)

- In a Wednesday press conference, the Federal Reserve Chair, Jerome Powell, stated that cryptocurrencies don’t pose a risk to the financial system. At the same time, stablecoins could prove useful if regulated. (link)

As USD Purchasing Power Decreases, Politicians Take Aim on Alternatives

It seems that shadowy magic is the latest go-to jargon for select politicians when discussing digital assets. After Sen. Elizabeth Warren pinned blockchain developers as shadowy super coders, Sen. Brown now called stablecoins ‘magic internet money’ because they are managed by private firms rather than being confined within the Fed’s magical infinite money printing machine.

However, some complaints have merit. One of the witnesses probed, Alexis Goldstein, noted that Ethereum’s high fees would make Western Union blush in embarrassment. Along this attack line, Sen. Warren marked a clear target — Decentralized Finance (DeFi) — as the only viable threat to the banking system, both commercial and central.

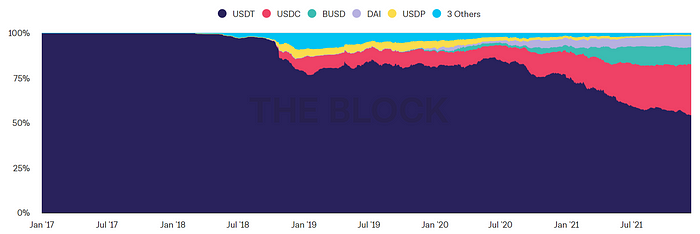

Share of total stablecoin supply slowly diversifies from initial USDT dominance. Image courtesy of The Block.

Sen. Warren sees stablecoins as the key ingredient that will cripple DeFi, and urges regulators to clamp down on them “before it is too late”. In stark contrast, Sen. Toomey sees promising potential in the stablecoin/DeFi sector, along with the expected birthing pains. He proposed that stablecoin issuers should either be governed as money transmitters, as conventional banks, or given special-purpose banking charter under new legislation.

Based on Powell’s statements and committee member moves, it’s safe to assume there will be some kind of clamp down on stablecoins next year. However, it is not likely to be a severe one if the US doesn’t want to lose a competitive edge on the world’s financial stage.

Fed to Hike Interest Rates, as Debt Ceiling Rises

- The much anticipated Federal Reserve announcement forecasts an interest rate increase to 0.75% by the end of 2022. (link)

- The US Senate voted to raise the debt ceiling by $2.5 trillion on Wednesday, staving off default until at least 2023. (link)

Will the Fed Walk the Talk or Talk the Talk?

After a historic money-printing spree during 2020/21, the Federal Reserve will start to withdraw its stimulus activity. Although these measures boosted the stock market, they have also overheated the economy, resulting in an inflation rate not seen in 39 years. In 2022, the plan is now to increase interest rates three times, most likely in 0.20–0.25% increments.

This leaves the market in a non-spooked state, with plenty of time to prepare. Even more so, the announcement was welcomed with confidence, demonstrated by several rises: S&P 500 by 1.63%, Nasdaq Composite by 2.15%, and Dow Jones Industrial Average by 1.08% — all within a day of the announcement.

The mechanism by which the Fed plans to trigger an interest rate hike is via winding down its $120 billion per month bond-acquisition program, one of the major inflation culprits. The wind down means a reduction of the program (aka quantitative easing) between $15 billion per month from November to $30 billion, starting in January.

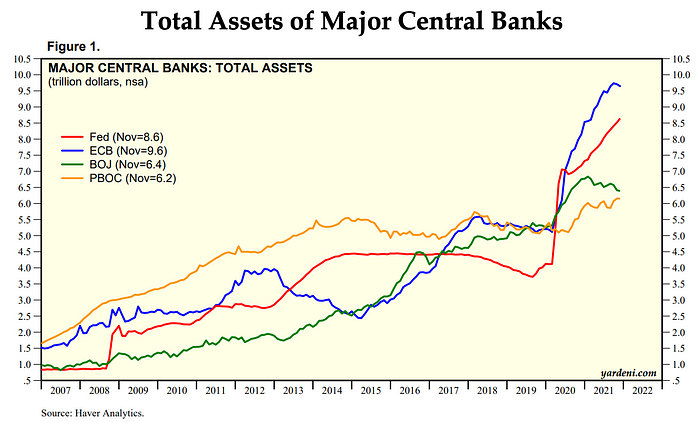

However, given the Fed’s track record and the reliance of the stock market on low interest rates for cheap borrowing, there may be a reversal of this policy if the stock market drops next year. After all, this Fed-market fusion has resulted in the longest bullrun in history. To bet against this from happening, would be to bet against the trend demonstrated by all major central banks.

The world’s economy is heavily influenced by central banks, swaying the stock market. Image courtesy of Yardeni Research, Inc.

If the Fed backtracks, the underlying inflation may not be resolved, but the US Bureau of Statistics already announced it will tweak how it is calculated. In the end, this would be a fine setup for cryptocurrencies, led by Bitcoin, to take center stage against the eroding dollar. Another $2.5 trillion debt increase will certainly not help it.

Tweets of the Week

The dollar is backed by a giant ecosystem that accepts that asset for services.

Crypto that supports smart contracts is backed by a small and growing ecosystem that accepts that asset for services.

Few understand this.

“Powell says “crypto is not backed by anything.”

What’s the Dollar backed by…?”

The tech-enabled insurance company Lemonade ($LMND) has officially confirmed that they are the latest publicly traded company to add bitcoin to their balance sheet.

Eventually every public company is going to do it.

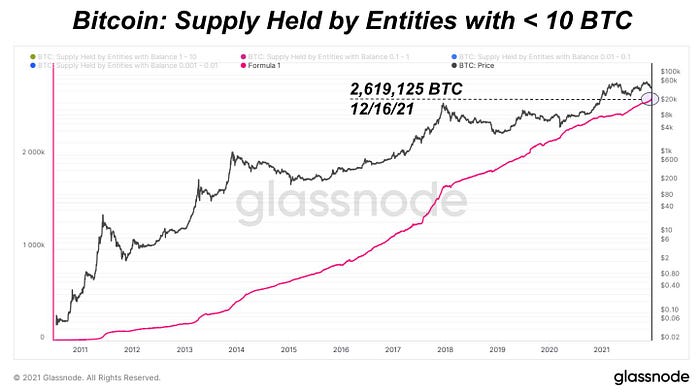

#Bitcoin supply held by entities with less than 10 BTC has only increased over time as global adoption continues.

These entities now hold 2,619,125 BTC.

Always be stacking.

We created #Bitcoin so the reckless central banks couldn’t financially engineer infinite hyperbolic “growth” thrusting the global population into a life sentence of indentured debt servitude to make more plastic trinkets that no one really wants.

On this day one year ago

1 #BTC = $19,418

1 #ETH = $589

1 #BNB = $29

1 #ADA = $0.15

1 #CRO = $0.066

1 #SHIB = $0.0000000001

1 #SOL = $1.68

1 #SAND = $0.0489

1 #DOGE = $0.0036

1 #MATIC = $0.0190

1 #VeChain = $0.0171

Join Five Minute Finance Newsletter.